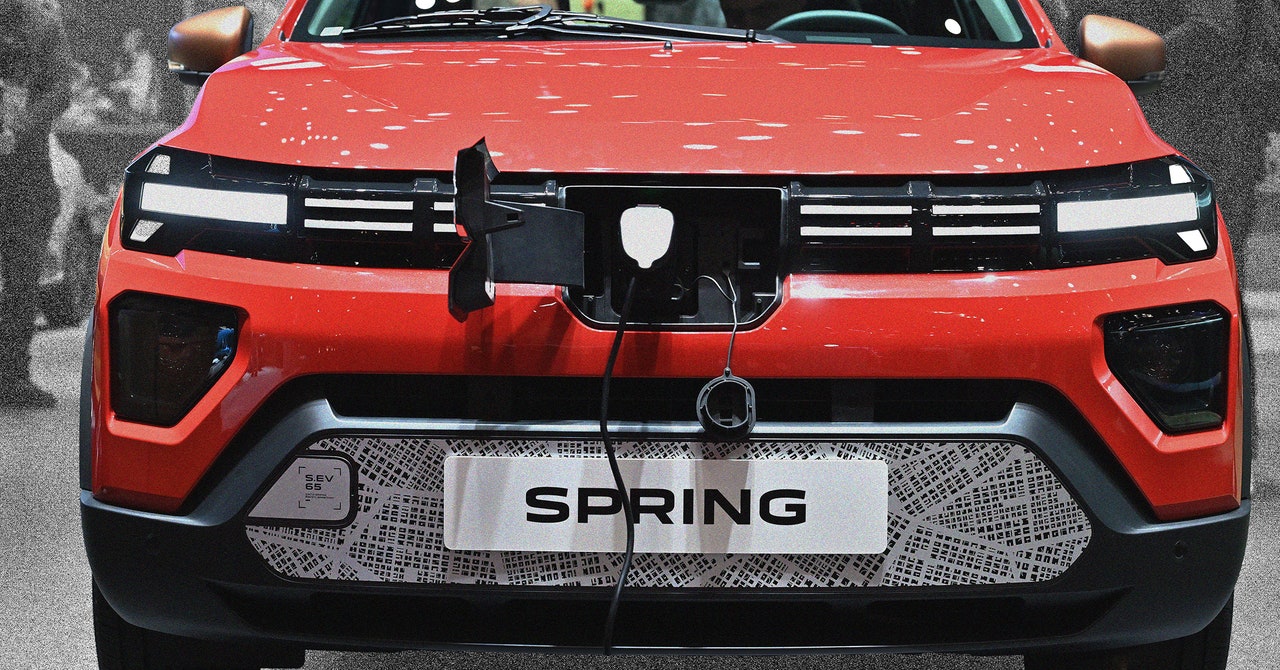

Regardless of which option is ultimately chosen, it probably won’t stop Chinese EVs from entering the European market. Just on Monday, Changan, another Chinese carmaker, announced plans to start selling its electric cars in Europe later this year. The Dacia Spring, a model that is manufactured by Renault Group partner Dongfeng in China, also maintains a very low price point even after accounting for tariffs.

A security threat?

There is one big difference between the responses to Chinese electric cars in Europe and the US: whether the cars are seen as a security threat.

In the U.S., not only is the tariff on Chinese-made EVs far more preemptive and punitive — 100 percent, hitting brands like Polestar — the trade discussion is also often bogged down by concerns that Chinese-made cars could become a security liability in the U.S. .

Last week, the Biden administration announced a ban on certain Chinese-made auto software and hardware, making it much more difficult for any Chinese company to even consider selling in the US. The inspection of this software and hardware mimics the inspection of Chinese-made applications and telecommunications infrastructure, concerned that it could allow the Chinese government to access American data.

As for cars, such security risks are almost entirely theoretical in the US, as there are currently few Chinese EVs sold in the country. While Europe has more Chinese EVs, the risk is still relatively low.

“The market share of Chinese carmakers across Europe is still low and growth is likely to slow significantly if the proposed tariffs are confirmed,” said John Lee, Berlin-based director of East West Futures Consulting. “Furthermore, the mandatory cybersecurity certification standards that came into effect across the EU in July 2024. for new vehicle registrations, have already had a negative impact on the sales of Chinese car manufacturers. So the problem of data security is still largely theoretical.”

Unlike the US government, which has shown a clear position to separate the country from the Chinese EV industry, Europe has invested much more in Chinese car manufacturers and the transition to green energy, making it much more difficult to purge Chinese EVs. “But much depends on Europe’s response to the recently proposed US ban on connected vehicles integrating Chinese hardware and software,” says Lee.

Indeed, senior EU officials began reiterating security concerns last week as soon as the US government proposed the ban. This type of discussion is slowly growing in Brussels, but it is yet to be influential.

“There is some interest in researching these risks because they are seen as a risk in the US,” Matzocco says. “But I don’t think that would be popular at the moment in many member states. And I don’t think you really hear that in political circles.